How Are AI and ML Shaking up the Asset Management Industry?

Crises, when they occur, have one very clear advantage: they force us to think and accelerate new processes. In 2020, we sat and observed the COVID-19 crisis cause widespread concern and economic hardship for consumers, businesses and communities across the globe. The asset management industry has also taken a step back to re-evaluate the way that it functions.

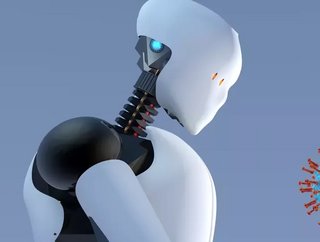

Advanced technology has begun to change as AI and machine learning takes an ever-greater portion of the asset management industry. It is invading further and further into the wider strategy domain, which was once the exclusive territory of human analysts.

Like any industry, asset management practitioners must adapt if they are to survive. Whether you are at home or in the workplace, technology such as AI and machine learning has become more central to our lives this year than ever before. From allowing our children to sit exams at home to contributing to the quest for a COVID vaccine, high-performing companies and organisations have increased their investment in AI amid the COVID-19 crisis, and this trend will only continue to rise.

Although often used interchangeably, the combination of Artificial Intelligence and Machine Learning can be particularly beneficial within the asset management industry. In short, AI is a broad catch-all term that describes the ability of a machine – usually a computer system – to act in a way that imitates intelligent human behaviour. By contrast, Machine Learning is the study of the algorithms and methods that enable computers to solve specific tasks without being explicitly instructed how and instead of doing so by identifying persistent relevant patterns within observed data.

Professionals in the asset management industry need to be able to predict the future effectively if they are to be successful and generate wealth for their investors, which explains why experts see Artificial Intelligence and Machine Learning as the most potentially disruptive technology for the industry in the coming 3 to 5 years.

Investment predictions, like all predictions, are made by combining information with a model or method along with the assumption that managers have some advantage which allows them to make predictions that are more likely to be right than wrong. The human ability to beat the market is waning, which leads to the failure of managers to generate promised returns. A key reason for this is the continued reliance on the same old information and methods used by investment managers to make decisions, along with the increased speed of change in the markets, which allows for models to become obsolete much more quickly than in the past.

Fortunately for us, advanced AI offers a solution to this dilemma. Machines have access to an infinite number of trading opportunities, so the models are constantly adapting to market trends, subsequently making them more dynamic and risk-averse. As 2021 looks likely to be another year of increased market volatility - machines will continue to be on the lookout for great opportunities throughout all points of the market cycle. We must not forget that the most significant challenge faced by investors is uncertainty. With AI, the uncertainty is simply handed to an algorithm where the predictions and timings are completely automated. The influence of emotional and cognitive bias can thus be incrementally removed over time, making the use of AI and machine learning a much better solution for the long and short term.

Overall, asset managers must continue to develop systematic and scientific investment processes in order to generate sustainable risk-adjusted returns for their trading activities. The use of AI can industrialise the invention process of trading models, and in doing so, outsmart the human mind. If we have learnt one thing from 2020, it is that asset management industries can reap substantial benefits through the implementation of AI and machine learning.