How EY is helping Lyft raise its post IPO game

Navigating the choppy waters of an IPO is never clear sailing. You just can’t second guess the way the deep, dark oceans of the free market are going to carry you. However, once you emerge on the other side of the tempest – that’s when the real work begins.

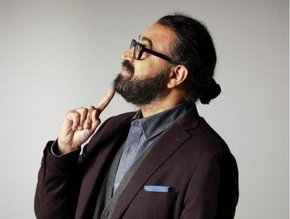

Three years and a global pandemic later Zach Greenberger from the US-based rideshare business, Lyft and Sanjay Khunti from EY explain how they weathered the storm together and how Lyft is now riding the crest of a wave on the back of the multi-billion-dollar offering.

Lyft raised more than two billion dollars in its 2019 IPO. Timing these events is often a hit or miss affair. Lyft nailed it with huge success. But keeping up that growth momentum and spending the money wisely whilst steering a route through the new regulatory constraints going public took serious teamwork.

And if that wasn’t enough, Lyft and EY had to exploit the benefits of a successful funding round just as the global pandemic took hold.

‘The IPO was a super exciting time for us,’ says Greenberger. ‘It necessitated a level of maturity and growth we needed to properly scale business operations.’

He says this is where Lyft’s relationship with EY became so critical.

Khunti agrees. ‘Absolutely. Lyft being in hyper-growth mode…but then having to face the requirements of being a public company meant it found itself in an interesting position. Working with EY at the Speed of Lyft, as we call it, meant they had a successful IPO and built a strong partnership.’

‘Operating in the public domain with a host of new regulations, laws and expectations from investors was just the tip of the iceberg.’

‘EY helped them through setting up their internal audit and SOX functions, designing their internal controls, redesigning the chart of accounts to scale with their targeted growth, and supporting the company’s financial transformation.

‘Sanjay is spot on,’ says Greenberger. EY brings a ton of expertise to support and augment our team and make sure we are building that proper foundation for long term success.’

According to Khunti, with so many separate business lines and units being developed under the Lyft banner – from rideshare to scooter hire to product delivery to name just three – EY needed to take a holistic approach.

‘One major step was to implement Oracle Financial Accounting Hub (FAH)’, he says. This gave Lyft a more scalable accounting system which was auditable, traceable and provides a complete and accurate picture of their financials and the data they need to make the right business decisions.

‘That was really the first step in getting this transformation journey started and it’s providing successful outcomes for our ongoing work together,’ says Khunti.