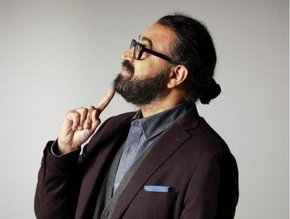

5 minutes with Martin Rehak from Resistant AI

Can you tell me about your company?

Resistant AI protects automation systems in financial services from manipulation, fraud, and financial crime. We use the same framework of machine learning-driven anomaly detection to spot unknown and emerging threats — whether that be in document forensics to catch forged documents, or in transaction monitoring to catch various kinds of fraud or money laundering.

What is your role and responsibilities at the company?

I am the CEO and co-founder of the business but I don’t consider myself a manager in the traditional sense. As a company, we consider ourselves a team of explorers, and that’s how we function. We have to be very open with each other because as a start-up, we have to make the right calls with limited information and time. Mistakes can be costly. So simplicity gives us speed, learning, and security.

How does Resistant AI utilise AI?

At the core, we are trying to bring back the common sense that gets lost when services move towards automation. Our main approach is anomaly detection — establishing what “good” looks like so that “bad” stands out — and we apply it to both document forensics and transaction monitoring.

With Resistant Documents, we forensically examine bank statements, invoices, delivery notes, doctor’s bills in insurance cases, even modified receipts to catch fraud. By establishing what an authentic document from a particular issuer looks like, we’re able to pick up forgeries that are invisible to the human eye. Post-COVID, a surprising amount of documents in today’s application flow are forged – from 1-2% in the best cases up to 15-20% in the high-risk applications.

With Resistant Transactions, we sit on top of the existing anti-fraud, credit scoring, and anti-money-laundering systems, and continuously monitor customer behaviours within, across, and between transactions. This allows us to dramatically reduce the number of false alerts produced from the underlying system and alleviate the workload from the front-line teams. Then, we find additional attacks. We intentionally look for the smart attackers – the criminals that are able to evade the existing defences and exploit vulnerabilities in banks’ systems. We often find attackers that rely on vulnerabilities in third-party systems – such as merchants, payment providers or scoring bureaus – to indirectly attack bank systems. Generated identities, synthetic identities, and other forms of identity theft are often based on this paradigm.

The important thing is that every verdict we render is substantiated with evidence, and helps real humans make decisions — because we believe the combination of human and artificial intelligence outperforms either alone. Compliance requirements in the space also mean white-box, explainable AI is a necessity, which is why we focus on machine learning over deep learning techniques.

What is it that interests you in AI and security?

Whilst studying in France I developed my passion for security. I started in telecommunications working with security systems and mobile banking before mobiles became smart. At that point I wanted to go against the trend so decided to study AI, which in 2004 was basically a field very few people were aware of. I later developed a company called Cognitive Security which used AI and machine learning to discover advanced attackers in computer networks. Cisco later bought the company and after remaining there for 12 years, my team and I felt we should move on to look for the fresh and unknown. At that point, Cisco had approximately 25 million users that we were protecting from advanced threats through cloud-based machine learning.

My co-founders and I had a meeting and thought about how criminals would go about stealing money in today’s world. We looked at how business was being conducted, we saw the wave of automation coming, and we saw all of the fintechs changing the world of banking. We realised how open to manipulation this automation could be when you take people out of the equation. So we started building technology that looked for the common sense that gets lost in automation. That’s what Resistant AI is all about, we want to stop the automation from being insecure and make it more secure.

What can we expect from Resistant AI in the future?

We are growing much faster than we expected and there is a far bigger demand for our services than ever before. We are expanding into the UK, Europe and North America and will be forming strategic partnerships to support this. However, we are just scratching the surface and fraud will continue growing exponentially as there is so much movement in that space. We want to be leaders, we want to be one of the first in the market to help the customers to beat those challenging attackers.